Loading

- FAQ

- TOS

- Privacy

Im facing a 503 error:

2023-01-19 03:45:36.783 ERROR: Found error. status: 503, error message:

ERROR: The request could not be satisfied

Ok im handling with it catching try/except but this code has running for months, and now its facing a 503 error, 3-4x times a day.

We are all getting this randomly or what im doing wrong?

Ps.: This error are from GET /fapi/v1/klines running in a AWS located in Tokyo.

Im thinking if i edit timeout for a longer period, perhaps will solve? NOPE IT DIDNT SOLVE

Perhaps its a common issue for AWS located at Tokyo?

Im confused.

Go to binance

r/binance

r/binance

A place to interact with the community, and discuss all things crypto and Binance!

Members

Online

•

by

Toplerrr

Anyone getting a 503 service temporarily unavailable when trying to access website or app

service temporarily unavailable when trying to access website or app

Когда сервер временно не может обработать запрос пользователя, он передает в браузер ответ об ошибке 503. Отсутствие доступа к сайту имеет негативные последствия как для посетителя, который не может просматривать нужный контент, так и для владельца веб-ресурса, рискующего потерять трафик и конверсию. Чаще всего причиной ошибки являются неправильные настройки сервера или движка, с помощью которого создан сайт (CMS). Их исправлением занимается администратор веб-ресурса. Однако иногда уведомление с кодом 503 возникает из-за сбоев на стороне пользователя. Такие неполадки легче и быстрее исправить, и сделать это может посетитель веб-ресурса самостоятельно. В данной статье мы разберем несколько способов устранения ошибки 503, которые могут предпринять администратор и пользователь сайта.

Что значит ошибка 503 Service Unavailable

Ошибка 503 Service Unavailable — это уведомление, которое отправляет сервер, чтобы сообщить о появлении технических неполадок и временной невозможности обработать запрос пользователя. Сообщение появляется на веб-странице, которую пытался открыть посетитель, если на сайте есть проблемный скрипт, на сервер поступает больше запросов, чем он может обработать, или на устройстве и сетевом оборудовании пользователя возникли проблемы с настройками.

Ошибка 503 на сайте означает, что сервер в порядке, но в данный момент недоступен. Чтобы хостинг-компьютер снова начал корректно отвечать браузеру, необходимо найти причину поломки. Это поможет выбрать правильное решение проблемы. Перечислим возможные источники «Error 503»:

- DDoS-атаки и вирусы, приводящие к перегрузке сервера;

- несогласованная работа компонентов веб-страницы (медиаконтента, стилей и скриптов) — элементы каждого уровня запрашиваются и отправляются отдельно;

- последствия хотлинка — сервер тратит трафик и другие вычислительные ресурсы на ответ посетителям других сайтов (если в чужие веб-страницы встроены файлы, хранящиеся на вашем сервере);

- непрерывное обращение к веб-серверу одного из элементов сайта — плагина, виджета, темы;

- сканирование сайта поисковыми роботами и парсерами;

- конфликты плагинов CMS;

- отключение сервера для обслуживания;

- направление большого количества тяжелых запросов к базе данных;

- наличие недостаточно оптимизированных скриптов;

- отправка объемных статичных файлов при помощи скриптов;

- работа почтового сервера — регулярная рассылка большого количества сообщений;

- подключение к удаленному серверу — может привести к лишним HTTP-запросам, тайм-аутам, обрывам связи и т. д.

Пользователю не стоит сразу отказываться от попыток восстановить работоспособность сайта и искать новый сервис. Error 503 может возникнуть из-за проблем с его компьютером, модемом, операционной системой, программным обеспечением и браузером. Если не устранить причину сбоя, ошибка будет систематически возникать и при посещении других веб-ресурсов. К тому же от него не требуется выполнения сложных действий или больших временных затрат — проверка наличия проблем на стороне пользователя займет всего несколько минут.

Как исправить ошибку 503 владельцу сайта

К ошибке HTTP 503 чаще всего приводят сбои, происходящие на сервере. Их исправление — ответственность владельца веб-сайта. Решение некоторых проблем не требует особых навыков, для других придется обратиться к вебмастеру или техническому специалисту с опытом в администрировании серверов.

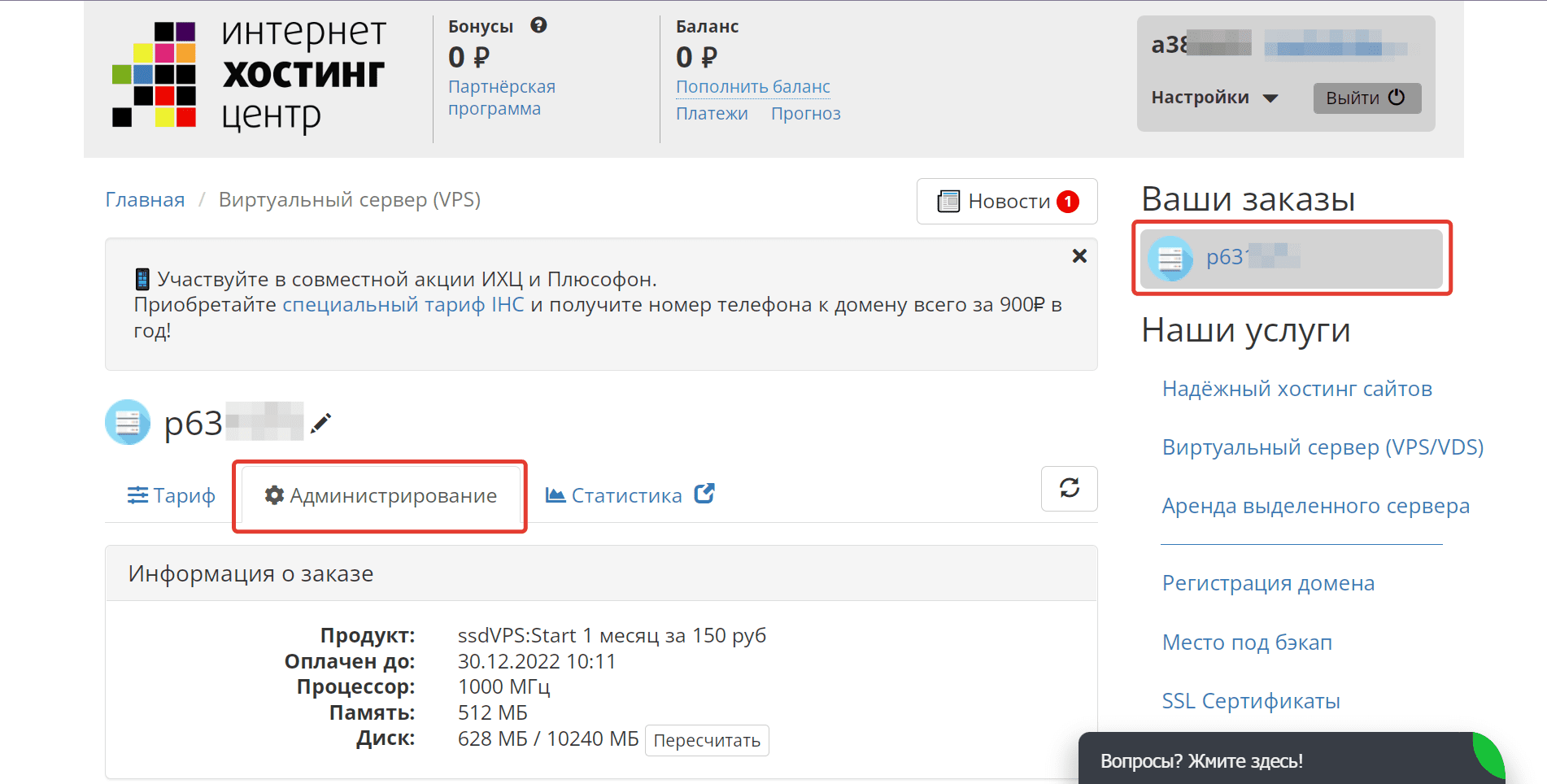

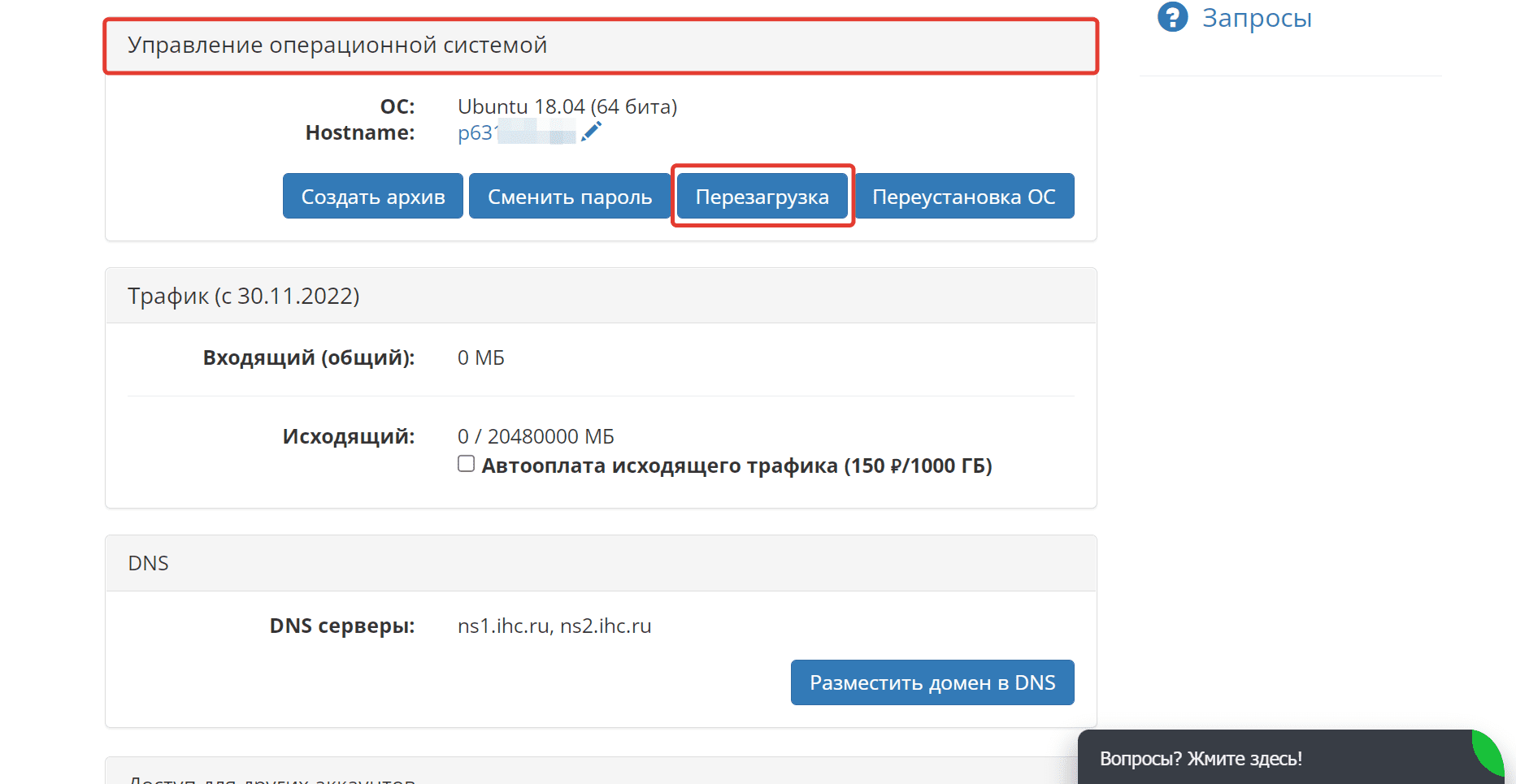

Перезагрузка сервера

Так же как перезагрузка модема и маршрутизатора помогает пользователям очистить кэш DNS-серверов, в котором накопился проблемный код, и вернуть доступ к веб-ресурсу, так и перезапуск сервера необходим администраторам для избавления от некоторых ошибок и восстановления работоспособности сайта. Если вы арендуете сервер или его часть у хостинг-провайдера, для перезагрузки сервера вам потребуется войти в панель управления хостингом и выполнить несколько действий:

-

Выберете нужный заказ и откройте вкладку «Администрирование».

-

Перейдите в пункт «Управление операционной системой» и нажмите кнопку «Перезагрузить».

На перезапуск системы уйдет всего несколько минут.

Автоматическое обслуживание

Даже хорошо оптимизированный веб-ресурс не может работать 100% времени. Сервер и расположенный на нем сайт могут стать временно недоступными при выполнении некоторых видов технических работ:

- установке обновлений операционной системы и приложений;

- проверке безопасности системы и поиске вредоносных программ;

- автоматическом обновлении CMS и ее компонентов (тем, плагинов) и так далее.

График проведения мероприятий по автоматическому обслуживанию сообщается администраторам сайтов заранее. Если предупредить пользователей о возможном появлении проблем с доступом к веб-ресурсу в определенный период времени, можно сократить количество отказов от просмотра сайта при появлении ошибки 503.

Проверка настроек конфигурации брандмауэра

Неправильно настроенный брандмауэр сервера может принять несколько связанных IP-адресов за DDOS-атаку. При выставлении параметров брандмауэра ориентируйтесь на особенности выбранной CMS и характеристики вашего веб-сервера.

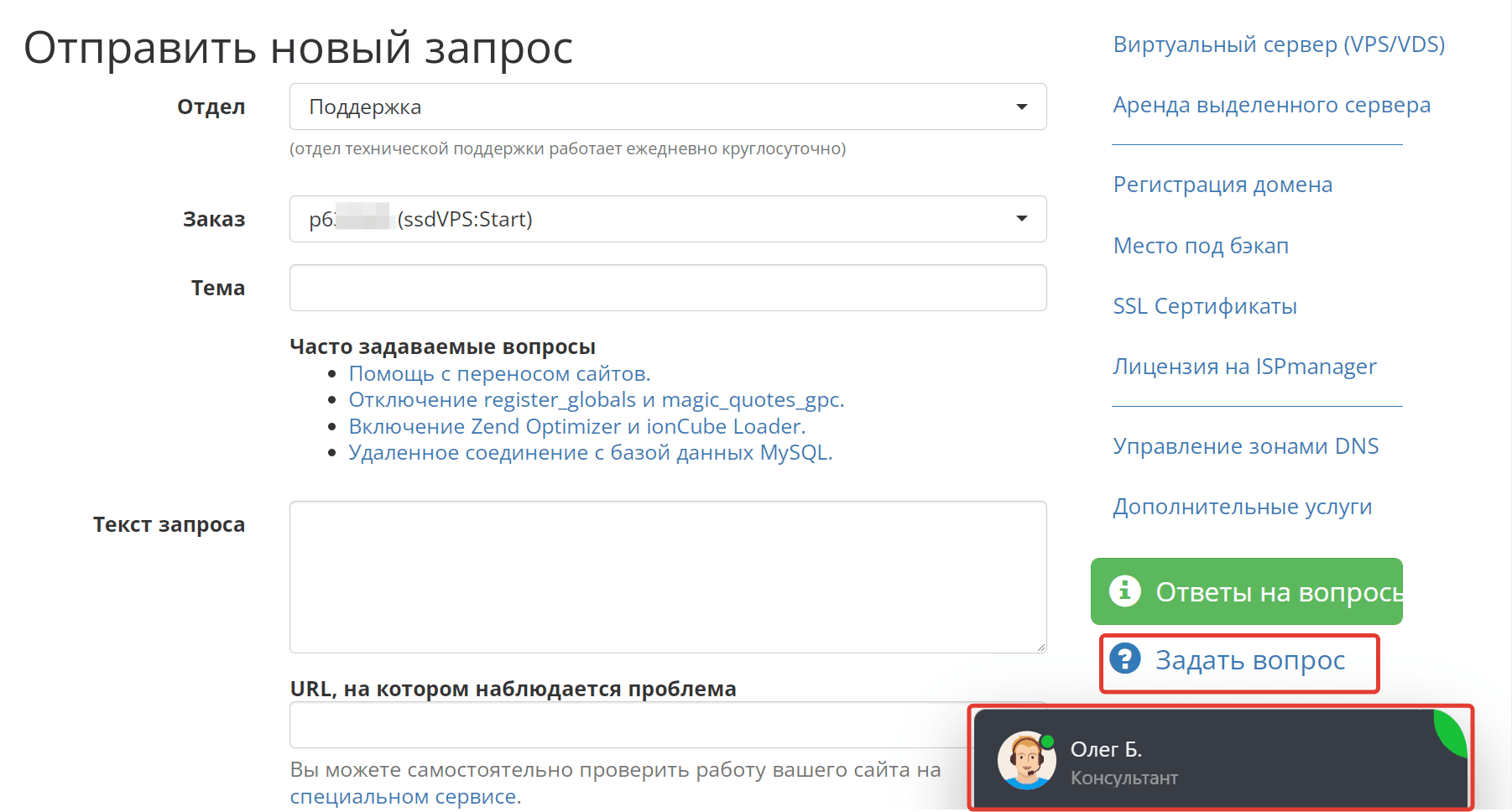

Обратитесь в службу технической поддержки

Если сайт недоступен и установить причину своими силами не удалось, обратитесь в службу технической поддержки хостинга. Специалист саппорта сообщит о технических работах и времени их окончания или поможет установить другой источник ошибки 503. В Интернет Хостинг Центре обратиться за помощью можно через раздел «Задать вопрос» в панели управления хостингом или через чат. При создании тикета необходимо подробно описать проблему и приложить скриншот.

Снижение нагрузки на сервер

Существует несколько способов справиться с большим количеством запросов, адресуемых серверу. Каждый из них подойдет для решения конкретной проблемы:

- Установка защитного экрана, например, CloudFlare, для защиты от хакерских атак и других угроз безопасности.

- Оптимизация и удаление лишних скриптов для быстрой обработки запросов.

- Выбор антилич-плагина, поддерживаемого вашей CMS, для защиты от хотлинка.

- Удаление компонентов, постоянно обращающихся к серверу.

- Запись в robots.txt пользовательских приложений (user agent), создающих нагрузку на сайт.

- Проверка совместимости плагинов и тем друг с другом путем их попеременного отключения и тестирования работы сайта без них.

- Обмен объемными файлами большого размера по протоколу FTP.

- Организация рассылки в период сниженной нагрузки на сервер, например, ранним утром.

- Контроль над количеством email-сообщений, отправляемых одновременно.

Как решить проблему, если вы — пользователь

Ошибка 503 происходит на сервере, и если ее обнаружил пользователь веб-ресурса, он может сообщить об этом владельцу сайта и подождать устранения проблемы. В получении контактов поможет сервис Whois, который проверяет регистрационные данные домена и содержит информацию о его арендаторе. Однако такое решение может занять большое количество времени, кроме того, не часто, но код 503 может появляться из-за ошибок на компьютере и сетевом оборудовании пользователя. Что пользователь может предпринять самостоятельно, чтобы убедиться, что он не является причиной временно отсутствия доступа к веб-ресурсу:

- Отключите от питания сетевое оборудование на три минуты. Если ошибка происходила из-за проблем с IP пользователя, после включения роутера адрес поменяется и сайт снова станет доступным.

- Перезагрузите модем. Если причина в ПО внешних устройств, передающих вам трафик, может помочь перезагрузка сетевого оборудования.

- Очистите кэш и другие временные файлы в браузере. Для этого воспользуйтесь сочетанием клавиш Ctrl+F5.

- Смените браузер или перезапустите его. Это поможет избавиться от ошибок в текущей сессии и понять, является ли браузер источником ошибки.

- Перезагрузите операционную систему. Сбой в ОС и программном обеспечении будет исправлен автоматически при новом запуске компьютера.

Заключение

Способов устранения ошибки 503 так же много, как и причин ее появления. Пока администратор сайта решает сложные технические вопросы, пользователь может проверить на причастность к сбоям собственную технику и установленное на ней ПО.

Похожие статьи

-

Пока вы ждете загрузки сайта в окне браузера, на его сервере происходит обработка запроса, в результате чего он выдает или не выдает вам нужную информацию. Часто в процессе выполнения пользовательского запроса возникают различные ошибки, и вместо страницы мы получаем сообщения вроде Error 401, 404, 504 и т. п. Это значит, что что-то пошло не так и сайт не смог выполнить запрашиваемое действие. Цифры в названии ошибки означают ее код. Он указывает на наличие определенного типа проблемы. Одной из самых распространенных является формулировка «403 Forbidden Error». В статье мы расскажем, что делать, когда появляется 403 ошибка на сайте, что это означает, почему возникает и как ее устранить.

-

Чтобы на веб-странице появился контент, браузер должен получить от сервера, на котором расположен сайт, необходимые данные. Когда на устройстве пользователя, на веб-сервере или на другом промежуточном узле (например, прокси) возникают неполадки, вместо содержимого сайта в браузере появляется страница с ошибкой. Для устранения сбоя, необходимо знать, на чьей стороне он произошел и по какой причине. Понять, что является источником проблемы, помогает цифровой код ошибки. Если он имеет формат 5xx, значит, сбой происходит на стороне сервера. Разбираем в статье ошибку 504 на сайте и способы ее устранения.

-

Посещая сайты в интернете, мы часто натыкаемся на различные ошибки при загрузке. Часть из них вызвана проблемами на стороне сервера, многие связаны с настройками пользовательского устройства, некоторые возникают из-за сбоев в работе интернет-служб. Страница «Error 1020 Access Denied» обычно открывается на веб-сайтах, которые используют сервисы компании Cloudflare (сеть доставки контента (CDN), защиты от DDoS-атак, DNS-серверы), когда та блокирует IP-адрес пользователя. Но существуют и другие причины, по которым возникает ошибка 1020 на сайте. Мы разберем ситуации, когда проблема носит локальный характер, и подскажем, как устранить эту неисправность на стороне пользователя.

Change Log

2023-02-02

REST

- Endpoint

POST /eapi/v1/transferis disabled.

2023-01-11

REST

- Add endpoint

GET /eapi/v1/orderto check order status.

2022-12-13

WEBSOCKET

- Add

uandpuin stream<symbol>@depth1000to get diff orderbook update.

2022-12-09

REST

- Add updateId field

uinGET /eapi/v1/depth - Add parameter

underlyinginGET /eapi/v1/exerciseHistoryto query exercise histroy by underlying

2022-11-18

REST

- New endpoint

GET /eapi/v1/openInterestis added to get options open interest for specific underlying on certain expiration date.

WEBSOCKET

- New stream

<underlyingAsset>@openInterest@<expirationDate>is added for real-time option open interest feed.

2022-11-16

WEBSOCKET

- New trade stream

<underlyingAsset>@tradeis added for all option trades on specific underlying asset. - Adjust format in stream

option_pair.

2022-11-03

REST

- New endpoint for Auto-Cancel All Open Orders will be added on 2022-11-07:

POST /eapi/v1/countdownCancelAll:Set Auto-Cancel All Open Orders (Kill-Switch) ConfigGET /eapi/v1/countdownCancelAll:Get Auto-Cancel All Open Orders (Kill-Switch) ConfigPOST /eapi/v1/countdownCancelAllHeartBeat:Auto-Cancel All Open Orders (Kill-Switch) Heartbeat

2022-09-20

WEBSOCKET

- New streams

<underlyingAsset>@markPriceand<underlyingAsset>@ticker@<expirationDate>are added. - Streams

<!miniTicker@arr>will be deprecated on 2022/10/30.

2022-09-14

REST

- Adjust endpoint field

strikePrice,makerFeeRate,takerFeeRate,minQty,maxQty,initialMargin,maintenanceMargin,minInitialMargin,minMaintenanceMarginto string in endpointGET /eapi/v1/exchangeInfo - Only finished orders within 5 days can be queried in

GET /eapi/v1/historyOrders

2022-09-05

REST

- Adjust response result in endpoint

DELETE /eapi/v1/allOpenOrdersByUnderlying

2022-08-22

REST

- Add

rateLimitsinformation in endpointGET /eapi/v1/exchangeInfo - Parameters

symbolset to not mandatory inGET /eapi/v1/userTrades

General Info

General API Information

- Some endpoints will require an API Key. Please refer to this page

- The base endpoint is: **https://eapi.binance.com

- All endpoints return either a JSON object or array.

- Data is returned in ascending order. Oldest first, newest last.

- All time and timestamp related fields are in milliseconds.

HTTP Return Codes

- HTTP

4XXreturn codes are used for for malformed requests;

the issue is on the sender’s side. - HTTP

403return code is used when the WAF Limit (Web Application Firewall) has been violated. - HTTP

429return code is used when breaking a request rate limit. - HTTP

418return code is used when an IP has been auto-banned for continuing to send requests after receiving429codes. - HTTP

5XXreturn codes are used for internal errors; the issue is on

Binance’s side. - HTTP

503return code is used when:- If there is an error message «Unknown error, please check your request or try again later.» returned in the response, the API successfully sent the request but not get a response within the timeout period.

It is important to NOT treat this as a failure operation; the execution status is UNKNOWN and could have been a success; - If there is an error message «Service Unavailable.» returned in the response, it means this is a failure API operation and the service might be unavailable at the moment, you need to retry later.

- If there is an error message «Internal error; unable to process your request. Please try again.» returned in the response, it means this is a failure API operation and you can resend your request if you need.

- If there is an error message «Unknown error, please check your request or try again later.» returned in the response, the API successfully sent the request but not get a response within the timeout period.

Error Codes and Messages

- Any endpoint can return an ERROR

The error payload is as follows:

{

"code": -1121,

"msg": "Invalid symbol."

}

- Specific error codes and messages defined in Error Codes.

General Information on Endpoints

- For

GETendpoints, parameters must be sent as aquery string. - For

POST,PUT, andDELETEendpoints, the parameters may be sent as a

query stringor in therequest bodywith content type

application/x-www-form-urlencoded. You may mix parameters between both the

query stringandrequest bodyif you wish to do so. - Parameters may be sent in any order.

- If a parameter sent in both the

query stringandrequest body, the

query stringparameter will be used.

LIMITS

- The

/eapi/v1/exchangeInforateLimitsarray contains objects related to the exchange’sRAW_REQUEST,REQUEST_WEIGHT, andORDERrate limits. These are further defined in theENUM definitionssection underRate limiters (rateLimitType). - A

429will be returned when either rate limit is violated.

IP Limits

- Every request will contain

X-MBX-USED-WEIGHT-(intervalNum)(intervalLetter)in the response headers which has the current used weight for the IP for all request rate limiters defined. - Each route has a

weightwhich determines for the number of requests each endpoint counts for. Heavier endpoints and endpoints that do operations on multiple symbols will have a heavierweight. - When a 429 is received, it’s your obligation as an API to back off and not spam the API.

- Repeatedly violating rate limits and/or failing to back off after receiving 429s will result in an automated IP ban (HTTP status 418).

- IP bans are tracked and scale in duration for repeat offenders, from 2 minutes to 3 days.

- The limits on the API are based on the IPs, not the API keys.

Order Rate Limits

- Every order response will contain a

X-MBX-ORDER-COUNT-(intervalNum)(intervalLetter)header which has the current order count for the account for all order rate limiters defined. - Rejected/unsuccessful orders are not guaranteed to have

X-MBX-ORDER-COUNT-**headers in the response. - The order rate limit is counted against each account.

Endpoint Security Type

- Each endpoint has a security type that determines the how you will

interact with it. - API-keys are passed into the Rest API via the

X-MBX-APIKEY

header. - API-keys and secret-keys are case sensitive.

- API-keys can be configured to only access certain types of secure endpoints.

For example, one API-key could be used for TRADE only, while another API-key

can access everything except for TRADE routes. - By default, API-keys can access all secure routes.

| Security Type | Description |

|---|---|

| NONE | Endpoint can be accessed freely. |

| TRADE | Endpoint requires sending a valid API-Key and signature. |

| USER_DATA | Endpoint requires sending a valid API-Key and signature. |

| USER_STREAM | Endpoint requires sending a valid API-Key. |

| MARKET_DATA | Endpoint requires sending a valid API-Key. |

TRADEandUSER_DATAendpoints areSIGNEDendpoints.

SIGNED (TRADE and USER_DATA) Endpoint Security

SIGNEDendpoints require an additional parameter,signature, to be

sent in thequery stringorrequest body.- Endpoints use

HMAC SHA256signatures. TheHMAC SHA256 signatureis a keyedHMAC SHA256operation.

Use yoursecretKeyas the key andtotalParamsas the value for the HMAC operation. - The

signatureis not case sensitive. - Please make sure the

signatureis the end part of yourquery stringorrequest body. totalParamsis defined as thequery stringconcatenated with the

request body.

Timing Security

- A

SIGNEDendpoint also requires a parameter,timestamp, to be sent which

should be the millisecond timestamp of when the request was created and sent. - An additional parameter,

recvWindow, may be sent to specify the number of

milliseconds aftertimestampthe request is valid for. IfrecvWindow

is not sent, it defaults to 5000.

The logic is as follows:

if (timestamp < (serverTime + 1000) && (serverTime - timestamp) <= recvWindow){

// process request

}

else {

// reject request

}

Serious trading is about timing. Networks can be unstable and unreliable,

which can lead to requests taking varying amounts of time to reach the

servers. With recvWindow, you can specify that the request must be

processed within a certain number of milliseconds or be rejected by the

server.

SIGNED Endpoint Examples for POST /eapi/v1/order

Here is a step-by-step example of how to send a vaild signed payload from the

Linux command line using echo, openssl, and curl.

| Key | Value |

|---|---|

| apiKey | dbefbc809e3e83c283a984c3a1459732ea7db1360ca80c5c2c8867408d28cc83 |

| secretKey | 2b5eb11e18796d12d88f13dc27dbbd02c2cc51ff7059765ed9821957d82bb4d9 |

| Parameter | Value |

|---|---|

| symbol | BTCUSDT |

| side | BUY |

| type | LIMIT |

| timeInForce | GTC |

| quantity | 1 |

| price | 9000 |

| recvWindow | 5000 |

| timestamp | 1591702613943 |

Example 1: As a query string

Example 1

HMAC SHA256 signature:

$ echo -n "symbol=BTC-210129-40000-C&side=BUY&type=LIMIT&timeInForce=GTC&quantity=1&price=2000&recvWindow=5000×tamp=1611825601400" | openssl dgst -sha256 -hmac "YtP1BudNOWZE1ag5uzCkh4hIC7qSmQOu797r5EJBFGhxBYivjj8HIX0iiiPof5yG"

(stdin)= 7c12045972f6140e765e0f2b67d28099718df805732676494238f50be830a7d7

curl command:

(HMAC SHA256)

$ curl -H "X-MBX-APIKEY: 22BjeOROKiXJ3NxbR3zjh3uoGcaflPu3VMyBXAg8Jj2J1xVSnY0eB4dzacdE9IWn" -X POST 'https://eapi.binance.com/eapi/v1/order' -d 'symbol=BTC-210129-40000-C&side=BUY&type=LIMIT&timeInForce=GTC&quantity=1&price=2000&recvWindow=5000×tamp=1611825601400&signature=7c12045972f6140e765e0f2b67d28099718df805732676494238f50be830a7d7'

- requestBody:

symbol=BTC-210129-40000-C

&side=BUY

&type=LIMIT

&timeInForce=GTC

&quantity=1

&price=2000

&recvWindow=5000

×tamp=1611825601400

Example 2: As a request body

Example 2

HMAC SHA256 signature:

$ echo -n "symbol=BTC-210129-40000-C&side=BUY&type=LIMIT&timeInForce=GTC&quantity=1&price=2000&recvWindow=5000×tamp=1611825601400" | openssl dgst -sha256 -hmac "YtP1BudNOWZE1ag5uzCkh4hIC7qSmQOu797r5EJBFGhxBYivjj8HIX0iiiPof5yG"

(stdin)= 7c12045972f6140e765e0f2b67d28099718df805732676494238f50be830a7d7

curl command:

(HMAC SHA256)

$ curl -H "X-MBX-APIKEY: 22BjeOROKiXJ3NxbR3zjh3uoGcaflPu3VMyBXAg8Jj2J1xVSnY0eB4dzacdE9IWn" -X POST 'https://eapi.binance.com/eapi/v1/order?symbol=BTC-210129-40000-C&side=BUY&type=LIMIT&timeInForce=GTC&quantity=1&price=2000&recvWindow=5000×tamp=1611825601400&signature=7c12045972f6140e765e0f2b67d28099718df805732676494238f50be830a7d7'

- queryString:

symbol=BTC-210129-40000-C

&side=BUY

&type=LIMIT

&timeInForce=GTC

&quantity=1

&price=2000

&recvWindow=5000

×tamp=1611825601400

Example 3: Mixed query string and request body

Example 3

HMAC SHA256 signature:

$ echo -n "symbol=BTC-210129-40000-C&side=BUY&type=LIMIT&timeInForce=GTCquantity=0.01&price=2000&recvWindow=5000×tamp=1611825601400" | openssl dgst -sha256 -hmac "YtP1BudNOWZE1ag5uzCkh4hIC7qSmQOu797r5EJBFGhxBYivjj8HIX0iiiPof5yG"

(stdin)= fa6045c54fb02912b766442be1f66fab619217e551a4fb4f8a1ee000df914d8e

curl command:

(HMAC SHA256)

$ curl -H "X-MBX-APIKEY: 22BjeOROKiXJ3NxbR3zjh3uoGcaflPu3VMyBXAg8Jj2J1xVSnY0eB4dzacdE9IWn" -X POST 'https://eapi.binance.com/eapi/v1/order?symbol=BTC-210129-40000-C&side=BUY&type=LIMIT&timeInForce=GTC' -d 'quantity=0.01&price=2000&recvWindow=5000×tamp=1611825601400&signature=fa6045c54fb02912b766442be1f66fab619217e551a4fb4f8a1ee000df914d8e'

- queryString:

symbol=BTC-210129-40000-C&side=BUY&type=LIMIT&timeInForce=GTC

- requestBody:

quantity=1&price=2000&recvWindow=5000×tamp=1611825601400

Note that the signature is different in example 3.

There is no & between «GTC» and «quantity=1».

Public Endpoints Info

Terminology

symbolrefers to the symbol name of a options contract symbolunderlyingrefers to the underlying symbol of a options contract symbolquoteAssetrefers to the asset that is the price of a symbol.settleAssetrefers to the settlement asset when options are exercised

ENUM definitions

Options contract type

- CALL

- PUT

Order side

- BUY

- SELL

Position side

- LONG

- SHORT

Time in force

- GTC — Good Till Cancel

- IOC — Immediate or Cancel

- FOK — Fill or Kill

Response Type (newOrderRespType)

- ACK

- RESULT

Order types (type)

- LIMIT

Order status (status)

- ACCEPTED

- REJECTED

- PARTIALLY_FILLED

- FILLED

- CANCELLED

Kline/Candlestick chart intervals:

m -> minutes; h -> hours; d -> days; w -> weeks; M -> months

- 1m

- 3m

- 5m

- 15m

- 30m

- 1h

- 2h

- 4h

- 6h

- 8h

- 12h

- 1d

- 3d

- 1w

- 1M

Rate limiters (rateLimitType)

REQUEST_WEIGHT

javascript

{

"rateLimitType": "REQUEST_WEIGHT",

"interval": "MINUTE",

"intervalNum": 1,

"limit": 2400

}

ORDERS

javascript

{

"rateLimitType": "ORDERS",

"interval": "MINUTE",

"intervalNum": 1,

"limit": 1200

}

-

REQUEST_WEIGHT

-

ORDERS

Rate limit intervals (interval)

- MINUTE

Filters

Filters define trading rules on a symbol or an exchange.

Symbol filters

PRICE_FILTER

/exchangeInfo format:

{

"filterType": "PRICE_FILTER",

"minPrice": "0.00000100",

"maxPrice": "100000.00000000",

"tickSize": "0.00000100"

}

The PRICE_FILTER defines the price rules for a symbol. There are 3 parts:

minPricedefines the minimumprice/stopPriceallowed; disabled onminPrice== 0.maxPricedefines the maximumprice/stopPriceallowed; disabled onmaxPrice== 0.tickSizedefines the intervals that aprice/stopPricecan be increased/decreased by; disabled ontickSize== 0.

Any of the above variables can be set to 0, which disables that rule in the price filter. In order to pass the price filter, the following must be true for price/stopPrice of the enabled rules:

- sell order

price>=minPrice - buy order

price<=maxPrice - (

price—minPrice) %tickSize== 0

LOT_SIZE

/exchangeInfo format:

{

"filterType": "LOT_SIZE",

"minQty": "0.00100000",

"maxQty": "100000.00000000",

"stepSize": "0.00100000"

}

The LOT_SIZE filter defines the quantity (aka «lots» in auction terms) rules for a symbol. There are 3 parts:

minQtydefines the minimumquantityallowed.maxQtydefines the maximumquantityallowed.stepSizedefines the intervals that aquantitycan be increased/decreased by.

In order to pass the lot size, the following must be true for quantity:

quantity>=minQtyquantity<=maxQty- (

quantity—minQty) %stepSize== 0

Market Data Endpoints

Test Connectivity

Response:

{}

GET /eapi/v1/ping

Test connectivity to the Rest API.

Weight:

1

Parameters:

NONE

Check Server Time

Response:

{

"serverTime": 1499827319559

}

GET /eapi/v1/time

Test connectivity to the Rest API and get the current server time.

Weight:

1

Parameters:

NONE

Exchange Information

Response:

{

"timezone": "UTC", // Time zone used by the server

"serverTime": 1592387337630, // Current system time

"optionContracts": [ // Option contract underlying asset info

{

"id": 1,

"baseAsset": "BTC", // Base currency

"quoteAsset": "USDT", // Quotation asset

"underlying": "BTCUSDT", // Name of the underlying asset of the option contract

"settleAsset": "USDT" // Settlement currency

}

],

"optionAssets": [ // Option asset info

{

"id": 1,

"name": "USDT" // Asset name

}

],

"optionSymbols": [ // Option trading pair info

{

"contractId": 2,

"expiryDate": 1660521600000, // expiry time

"filters": [

{

"filterType": "PRICE_FILTER",

"minPrice": "0.02",

"maxPrice": "80000.01",

"tickSize": "0.01"

},

{

"filterType": "LOT_SIZE",

"minQty": "0.01",

"maxQty": "100",

"stepSize": "0.01"

}

],

"id": 17,

"symbol": "BTC-220815-50000-C", // Trading pair name

"side": "CALL", // Direction: CALL long, PUT short

"strikePrice": "50000", // Strike price

"underlying": "BTCUSDT", // Underlying asset of the contract

"unit": 1, // Contract unit, the quantity of the underlying asset represented by a single contract.

"makerFeeRate": "0.0002", // maker commission rate

"takerFeeRate": "0.0002", // taker commission rate

"minQty": "0.01", // Minimum order quantity

"maxQty": "100", // Maximum order quantity

"initialMargin": "0.15", // Initial Magin Ratio

"maintenanceMargin": "0.075", // Maintenance Margin Ratio

"minInitialMargin": "0.1", // Min Initial Margin Ratio

"minMaintenanceMargin": "0.05", // Min Maintenance Margin Ratio

"priceScale": 2, // price precision

"quantityScale": 2, // quantity precision

"quoteAsset": "USDT" // Quotation asset

}

],

"rateLimits": [

{

"rateLimitType": "REQUEST_WEIGHT",

"interval": "MINUTE",

"intervalNum": 1,

"limit": 2400

},

{

"rateLimitType": "ORDERS",

"interval": "MINUTE",

"intervalNum": 1,

"limit": 1200

},

{

"rateLimitType": "ORDERS",

"interval": "SECOND",

"intervalNum": 10,

"limit": 300

}

]

}

GET /eapi/v1/exchangeInfo

Current exchange trading rules and symbol information

Weight:

1

Parameters:

NONE

Order Book

Response:

{

"T": 1589436922972, // transaction time

"u": 37461 // update id

"bids": [ // Buy order

[

"1000", // Price

"0.9" // Quantity

]

],

"asks": [ // Sell order

[

"1100", // Price

"0.1" // Quantity

]

]

}

GET /eapi/v1/depth

Weight:

1

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | YES | Option trading pair, e.g BTC-200730-9000-C |

| limit | INT | NO | Default:100 Max:1000.Optional value:[10, 20, 50, 100, 500, 1000] |

Recent Trades List

Response:

[

{

"id":"1", // TradeId

"symbol": "BTC-220722-19000-C",

"price": "1000", // Completed trade price

"qty": "-0.1", // Completed trade quantity

"quoteQty": "-100", // Completed trade amount

"side": -1 // Completed trade direction(-1 Sell,1 Buy)

"time": 1592449455993,// Time

}

]

GET /eapi/v1/trades

Get recent market trades

Weight:

5

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | YES | Option trading pair, e.g BTC-200730-9000-C |

| limit | INT | NO | Number of records Default:100 Max:500 |

Old Trades Lookup (MARKET_DATA)

Response:

[

{

"id":"1", // UniqueId

"tradeId": "159244329455993", // TradeId

"price": "1000", // Completed trade price

"qty": "-0.1", // Completed trade Quantity

"quoteQty": "-100", // Completed trade amount

"side": -1 // Completed trade direction(-1 Sell,1 Buy)

"time": 1592449455993,// Time

}

]

GET /eapi/v1/historicalTrades

Get older market historical trades.

Weight:

20

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | YES | Option trading pair, e.g BTC-200730-9000-C |

| fromId | LONG | NO | The UniqueId ID from which to return. The latest deal record is returned by default |

| limit | INT | NO | Number of records Default:100 Max:500 |

Kline/Candlestick Data

Response:

[

{

"open": "950", // Opening price

"high": "1100", // Highest price

"low": "900", // Lowest price

"close": "1000", // Closing price (latest price if the current candle has not closed)

"volume": "100" // Trading volume(contracts)

"amount": "2", // Trading amount(in quote asset)

"interval": "5m", // Candle type

"tradeCount": 10, // Number of completed trades

"takerVolume": "100", // Taker trading volume(contracts)

"takerAmount": "10000", // Taker trade amount(in quote asset)

"openTime": 1499040000000, // Opening time

"closeTime": 1499644799999, // Closing time

}

]

GET /eapi/v1/klines

Kline/candlestick bars for an option symbol.

Klines are uniquely identified by their open time.

Weight:

1

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | YES | Option trading pair, e.g BTC-200730-9000-C |

| interval | STRING | YES | Time interval |

| startTime | LONG | NO | Start Time 1592317127349 |

| endTime | LONG | NO | End Time |

| limit | INT | NO | Number of records Default:500 Max:1500 |

- If startTime and endTime are not sent, the most recent klines are returned.

Option Mark Price

Response:

[

{

"symbol": "BTC-200730-9000-C",

"markPrice": "1343.2883", // Mark price

"bidIV": "1.40000077", // Implied volatility Buy

"askIV": "1.50000153", // Implied volatility Sell

"markIV": "1.45000000" // Implied volatility mark

"delta": "0.55937056", // delta

"theta": "3739.82509871", // theta

"gamma": "0.00010969", // gamma

"vega": "978.58874732", // vega

"highPriceLimit": "1618.241", // Current highest buy price

"lowPriceLimit": "1068.3356" // Current lowest sell price

}

]

GET /eapi/v1/mark

Option mark price and greek info.

Weight:

5

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | NO | Option trading pair, e.g BTC-200730-9000-C |

24hr Ticker Price Change Statistics

Response:

[

{

"symbol": "BTC-200730-9000-C",

"priceChange": "-16.2038", //24-hour price change

"priceChangePercent": "-0.0162", //24-hour percent price change

"lastPrice": "1000", //Last trade price

"lastQty": "1000", //Last trade amount

"open": "1016.2038", //24-hour open price

"high": "1016.2038", //24-hour high

"low": "0", //24-hour low

"volume": "5", //Trading volume(contracts)

"amount": "1", //Trade amount(in quote asset)

"bidPrice":"999.34", //The best buy price

"askPrice":"1000.23", //The best sell price

"openTime": 1592317127349, //Time the first trade occurred within the last 24 hours

"closeTime": 1592380593516, //Time the last trade occurred within the last 24 hours

"firstTradeId": 1, //First trade ID

"tradeCount": 5, //Number of trades

"strikePrice": "9000", //Strike price

"exercisePrice": "3000.3356" //return estimated settlement price one hour before exercise, return index price at other times

}

]

GET /eapi/v1/ticker

24 hour rolling window price change statistics.

Weight:

5

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | NO | Option trading pair, e.g BTC-200730-9000-C |

Symbol Price Ticker

Response:

{

"time": 1656647305000,

"indexPrice": "9200" // Current spot index price

}

GET /eapi/v1/index

Get spot index price for option underlying.

Weight:

1

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| underlying | STRING | YES | Spot pair(Option contract underlying asset, e.g BTCUSDT) |

Historical Exercise Records

Response:

[

{

"symbol": "BTC-220121-60000-P", // symbol

"strikePrice": "60000", // strike price

"realStrikePrice": "38844.69652571", // real strike price

"expiryDate": 1642752000000, // Exercise time

"strikeResult": "REALISTIC_VALUE_STRICKEN" // strike result

}

]

GET /eapi/v1/exerciseHistory

REALISTIC_VALUE_STRICKEN -> Exercised

EXTRINSIC_VALUE_EXPIRED -> Expired OTM

Get historical exercise records.

Weight:

3

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| underlying | STRING | NO | Underlying index like BTCUSDT |

| startTime | LONG | NO | Start Time |

| endTime | LONG | NO | End Time |

| limit | INT | NO | Number of records Default:100 Max:100 |

Open interest

Response:

[

{

"symbol": "ETH-221119-1175-P",

"sumOpenInterest": "4.01",

"sumOpenInterestUsd": "4880.2985615624",

"timestamp": "1668754020000"

}

]

GET /eapi/v1/openInterest

Get open interest for specific underlying asset on specific expiration date.

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| underlyingAsset | STRING | YES | underlying asset, e.g ETH/BTC |

| expiration | STRING | YES | expiration date, e.g 221225 |

Account/Trades Endpoints

Option Account Information (TRADE)

Response:

{

"asset": [

{

"asset": "USDT", // Asset type

"marginBalance": "1877.52214415", // Account balance

"equity": "617.77711415", // Account equity

"available": "0", // Available funds

"locked": "2898.92389933", // locked balance for order and position

"unrealizedPNL": "222.23697000", // Unrealized profit/loss

}

],

"greek": [

{

"underlying":"BTCUSDT" // Option Underlying

"delta": "-0.05" // Account delta

"gamma": "-0.002" // Account gamma

"theta": "-0.05" // Account theta

"vega": "-0.002" // Account vega

}

],

"time": 1592449455993 // Time

}

GET /eapi/v1/account (HMAC SHA256)

Get current account information.

Weight:

3

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| recvWindow | LONG | NO | |

| timestamp | LONG | YES |

Funds Transfer (TRADE)

Please find details from here.

New Order (TRADE)

Response ACK:

{

"orderId": 4611875134427365377, // System order number

"clientOrderId": "" // Client order ID

"symbol": "BTC-200730-9000-C", // Option trading pair

"price": "100", // Order Price

"quantity": "1", // Order Quantity

"side": "BUY", // Buy/sell direction

"type": "LIMIT", // Order type

"createDate": 1592465880683, // Order Time

"updateTime": 1566818724722, // Update time

}

Response RESULT:

{

"orderId": 4611875134427365377, // System order number

"symbol": "BTC-200730-9000-C", // Option trading pair

"price": "100", // Order Price

"quantity": "1", // Order Quantity

"executedQty": "0", // Number of executed quantity

"fee": "0", // Fee

"side": "BUY", // Buy/sell direction

"type": "LIMIT", // Order type

"timeInForce": "GTC", // Time in force method

"reduceOnly": false, // Order is reduce only Y/N

"postOnly": false, // Order is post only

"createTime": 1592465880683, // Order Time

"updateTime": 1566818724722, // Update time

"status": "ACCEPTED", // Order status

"avgPrice": "0", // Average price of completed trade

"clientOrderId": "" // Client order ID

"priceScale": 2,

"quantityScale": 2,

"optionSide": "CALL",

"quoteAsset": "USDT",

"mmp": false

}

POST /eapi/v1/order (HMAC SHA256)

Send a new order.

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | YES | Option trading pair, e.g BTC-200730-9000-C |

| side | ENUM | YES | Buy/sell direction: SELL, BUY |

| type | ENUM | YES | Order Type: LIMIT(only support limit) |

| quantity | DECIMAL | YES | Order Quantity |

| price | DECIMAL | NO | Order Price |

| timeInForce | ENUM | NO | Time in force method(Default GTC) |

| reduceOnly | BOOLEAN | NO | Reduce Only(Default false) |

| postOnly | BOOLEAN | NO | Post Only(Default false) |

| newOrderRespType | ENUM | NO | «ACK», «RESULT», Default «ACK» |

| clientOrderId | STRING | NO | User-defined order ID cannot be repeated in pending orders |

| isMmp | BOOLEAN | NO | is market maker protection order, true/false |

| recvWindow | LONG | NO | |

| timestamp | LONG | YES |

Some parameters are mandatory depending on the order type as follows:

| Type | Mandatory parameters |

|---|---|

| LIMIT | timeInForce, quantity, price |

Place Multiple Orders (TRADE)

Response:

[

{

"orderId": 4612288550799409153, // System order number

"symbol": "ETH-220826-1800-C", // Option trading pair

"price": "100", // Order Price

"quantity": "0.01", // Order Quantity

"side": "BUY", // Buy/sell direction

"type": "LIMIT", // Order type

"reduceOnly": false, // Order is reduce only Y/N

"postOnly": false, // Post only or not

"clientOrderId": "1001", // Client order ID

"mmp": false // MMP

}

]

POST /eapi/v1/batchOrders (HMAC SHA256)

Send multiple option orders.

Weight:

5

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| orders | LIST | YES | order list. Max 5 orders |

| recvWindow | LONG | NO | |

| timestamp | LONG | YES |

Where batchOrders is the list of order parameters in JSON:

- example: /eapi/v1/batchOrders?orders=[{«symbol»:»BTC-210115-35000-C»,

«price»:»100″,»quantity»:»0.0002″,»side»:»BUY»,»type»:»LIMIT»}]

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | YES | Option trading pair, e.g BTC-200730-9000-C |

| side | ENUM | YES | Buy/sell direction: SELL, BUY |

| type | ENUM | YES | Order Type: LIMIT (Only support LIMIT) |

| quantity | DECIMAL | YES | Order Quantity |

| price | DECIMAL | NO | Order Price |

| timeInForce | ENUM | NO | Time in force method(Default GTC) |

| reduceOnly | BOOLEAN | NO | Reduce Only(Default false) |

| postOnly | BOOLEAN | NO | Post Only(Default false) |

| newOrderRespType | ENUM | NO | «ACK», «RESULT», Default «ACK» |

| clientOrderId | STRING | NO | User-defined order ID cannot be repeated in pending orders |

| isMmp | BOOLEAN | NO | is market maker protection order, true/false |

Some parameters are mandatory depending on the order type as follows:

| Type | Mandatory parameters |

|---|---|

| LIMIT | timeInForce, quantity, price |

- Parameter rules are same with New Order

- Batch orders are processed concurrently, and the order of matching is not guaranteed.

- The order of returned contents for batch orders is the same as the order of the order list.

Query Single Order (TRADE)

Response:

{

"orderId": 4611875134427365377, // System order id

"symbol": "BTC-200730-9000-C", // Option trading pair

"price": "100", // Order Price

"quantity": "1", // Order Quantity

"executedQty": "0", // Number of executed quantity

"fee": "0", // Fee

"side": "BUY", // Buy/sell direction

"type": "LIMIT", // Order type

"timeInForce": "GTC", // Time in force method

"reduceOnly": false, // Order is reduce only Y/N

"postOnly": false, // Order is post only

"createTime": 1592465880683, // Order Time

"updateTime": 1566818724722, // Update time

"status": "ACCEPTED", // Order status

"avgPrice": "0", // Average price of completed trade

"source": "API", // Order source

"clientOrderId": "" // Client order ID

"priceScale": 2,

"quantityScale": 2,

"optionSide": "CALL",

"quoteAsset": "USDT",

"mmp": false

}

No Order Response:

{

"code": -2013,

"msg": "Order does not exist"

}

GET /eapi/v1/order (HMAC SHA256)

Check an order status.

Weight:

1

- These orders will not be found:

- order status is

CANCELEDorREJECTED, AND - order has NO filled trade, AND

- created time + 3 days < current time

- order status is

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | YES | Option trading pair, e.g BTC-200730-9000-C |

| orderId | STRING | NO | Order id |

| clientOrderId | STRING | NO | User-defined order ID cannot be repeated in pending orders |

| recvWindow | LONG | NO | |

| timestamp | LONG | YES |

- Either

orderIdorclientOrderIdmust be sent.

Cancel Option Order (TRADE)

Response:

{

"orderId": 4611875134427365377, // System order number

"symbol": "BTC-200730-9000-C", // Option trading pair

"price": "100", // Order Price

"quantity": "1", // Order Quantity

"executedQty": "0", // Number of executed quantity

"fee": "0", // Fee

"side": "BUY", // Buy/sell direction

"type": "LIMIT", // Order type

"timeInForce": "GTC", // Time in force method

"reduceOnly": false, // Order is reduce only Y/N

"postOnly": false,

"createDate": 1592465880683, // Order Time

"updateTime": 1566818724722, // Update time

"status": "ACCEPTED", // Order status

"avgPrice": "0", // Average price of completed trade

"source": "API",

"clientOrderId": "", // Client order ID

"priceScale": 4,

"quantityScale": 4,

"optionSide": "CALL",

"quoteAsset": "USDT",

"mmp": false

}

DELETE /eapi/v1/order (HMAC SHA256)

Cancel an active order.

Weight:

1

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | YES | Option trading pair, e.g BTC-200730-9000-C |

| orderId | LONG | NO | Order ID, e.g 4611875134427365377 |

| clientOrderId | STRING | NO | User-defined order ID, e.g 10000 |

| recvWindow | LONG | NO | |

| timestamp | LONG | YES |

At least one instance of orderId and clientOrderId must be sent.

Cancel Multiple Option Orders (TRADE)

Response:

[

{

"orderId": 4611875134427365377, // System order number

"symbol": "BTC-200730-9000-C", // Option trading pair

"price": "100", // Order Price

"quantity": "1", // Order Quantity

"executedQty": "0", // Number of completed quantity

"fee": 0, // Fee

"side": "BUY", // Buy/sell direction

"type": "LIMIT", // Order type

"timeInForce": "GTC", // Time in force method

"createTime": 1592465880683, // Order Time

"status": "ACCEPTED", // Order status

"avgPrice": "0", // Average price of completed trade

"reduceOnly": false, // Order is reduce only Y/N

"clientOrderId": "" // Client order ID

"updateTime": 1566818724722, // Update time

}

]

DELETE /eapi/v1/batchOrders (HMAC SHA256)

Cancel an active order.

Weight:

1

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | YES | Option trading pair, e.g BTC-200730-9000-C |

| orderIds | LIST<LONG> | NO | Order ID, e.g [4611875134427365377,4611875134427365378] |

| clientOrderIds | LIST<STRING> | NO | User-defined order ID, e.g [«my_id_1″,»my_id_2»] |

| recvWindow | LONG | NO | |

| timestamp | LONG | YES |

At least one instance of orderId and clientOrderId must be sent.

Cancel all Option orders on specific symbol (TRADE)

Response:

{

"code": 0,

"msg": "success"

}

DELETE /eapi/v1/allOpenOrders (HMAC SHA256)

Cancel all active order on a symbol.

Weight:

1

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | YES | Option trading pair, e.g BTC-200730-9000-C |

| recvWindow | LONG | NO | |

| timestamp | LONG | YES |

Cancel All Option Orders By Underlying (TRADE)

Response:

{

"code": "0",

"msg": "success",

"data": 0

}

DELETE /eapi/v1/allOpenOrdersByUnderlying (HMAC SHA256)

Cancel all active orders on specified underlying.

Weight:

1

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| underlying | STRING | YES | Option underlying, e.g BTCUSDT |

| recvWindow | LONG | NO | |

| timestamp | LONG | YES |

Query Current Open Option Orders (USER_DATA)

Response:

[

{

"orderId": 4611875134427365377, // System order number

"symbol": "BTC-200730-9000-C", // Option trading pair

"price": "100", // Order Price

"quantity": "1", // Order Quantity

"executedQty": "0", // Number of completed trades

"fee": "0", // Fee

"side": "BUY", // Buy/sell direction

"type": "LIMIT", // Order type

"timeInForce": "GTC", // Time in force method

"reduceOnly": false, // Order is reduce only Y/N

"postOnly": false,

"createTime": 1592465880683, // Order Time

"updateTime": 1592465880683, // Update Time

"status": "ACCEPTED", // Order status

"avgPrice": "0", // Average price of completed trade

"clientOrderId": "" // Client order ID

"priceScale": 2,

"quantityScale": 2,

"optionSide": "CALL",

"quoteAsset": "USDT",

"mmp": false

}

]

GET /eapi/v1/openOrders (HMAC SHA256)

Query current all open orders, status: ACCEPTED PARTIALLY_FILLED

Weight:

1 for a single symbol; 40 when the symbol parameter is omitted

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | NO | return all orders if don’t pass, Option trading pair, e.g BTC-200730-9000-C, |

| orderId | LONG | NO | Returns the orderId and subsequent orders, the most recent order is returned by default |

| startTime | LONG | NO | Start Time |

| endTime | LONG | NO | End Time |

| limit | INT | NO | Number of result sets returned Default:100 Max:1000 |

| recvWindow | LONG | NO | |

| timestamp | LONG | YES |

Query Option Order History (TRADE)

Response:

[

{

"orderId": 4611922413427359795,

"symbol": "BTC-220715-2000-C",

"price": "18000.00000000",

"quantity": "-0.50000000",

"executedQty": "-0.50000000",

"fee": "3.00000000",

"side": "SELL",

"type": "LIMIT",

"timeInForce": "GTC",

"reduceOnly": false,

"postOnly": false,

"createTime": 1657867694244,

"updateTime": 1657867888216,

"status": "FILLED",

"reason": "0",

"avgPrice": "18000.00000000",

"source": "API",

"clientOrderId": "",

"priceScale": 2,

"quantityScale": 2,

"optionSide": "CALL",

"quoteAsset": "USDT",

"mmp": false

}

]

GET /eapi/v1/historyOrders (HMAC SHA256)

Query all finished orders within 5 days, finished status: CANCELLED FILLED REJECTED.

Weight:

3

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | YES | Option trading pair |

| orderId | LONG | NO | Returns the orderId and subsequent orders, the most recent order is returned by default |

| startTime | LONG | NO | Start Time, e.g 1593511200000 |

| endTime | LONG | NO | End Time, e.g 1593512200000 |

| limit | INT | NO | Number of result sets returned Default:100 Max:1000 |

| recvWindow | LONG | NO | |

| timestamp | LONG | YES |

Option Position Information (USER_DATA)

Response:

[

{

"entryPrice": "1000", // Average entry price

"symbol": "BTC-200730-9000-C", // Option trading pair

"side": "SHORT", // Position direction

"quantity": "-0.1", // Number of positions (positive numbers represent long positions, negative number represent short positions)

"reducibleQty": "0", // Number of positions that can be reduced

"markValue": "105.00138", // Current market value

"ror": "-0.05", // Rate of return

"unrealizedPNL": "-5.00138", // Unrealized profit/loss

"markPrice": "1050.0138", // Mark price

"strikePrice": "9000", // Strike price

"positionCost": "1000.0000", // Position cost

"expiryDate": 1593511200000 // Exercise time

"priceScale": 2,

"quantityScale": 2,

"optionSide": "CALL",

"quoteAsset": "USDT"

}

]

GET /eapi/v1/position (HMAC SHA256)

Get current position information.

Weight:

5

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | NO | Option trading pair, e.g BTC-200730-9000-C |

| recvWindow | LONG | NO | |

| timestamp | LONG | YES |

Account Trade List (USER_DATA)

Response:

[

{

"id": 4611875134427365377, // unique id

"tradeId": 239, // trade id

"orderId": 4611875134427365377, // order id

"symbol": "BTC-200730-9000-C", // option symbol

"price": "100", // trade price

"quantity": "1", // trade quantity

"fee": "0", // fee

"realizedProfit": "0.00000000", // realized profit/loss

"side": "BUY", // order side

"type": "LIMIT", // order type

"volatility": "0.9", // volatility

"liquidity": "TAKER", // TAKER or MAKER

"quoteAsset": "USDT", // quote asset

"time": 1592465880683 // trade time

"priceScale": 2,

"quantityScale": 2,

"optionSide": "CALL",

"quoteAsset": "USDT"

}

]

GET /eapi/v1/userTrades (HMAC SHA256)

Get trades for a specific account and symbol.

Weight:

5

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | NO | Option symbol, e.g BTC-200730-9000-C |

| fromId | LONG | NO | Trade id to fetch from. Default gets most recent trades, e.g 4611875134427365376 |

| startTime | LONG | NO | Start time, e.g 1593511200000 |

| endTime | LONG | NO | End time, e.g 1593512200000 |

| limit | INT | NO | Default 100; max 1000 |

| recvWindow | LONG | NO | |

| timestamp | LONG | YES |

User Exercise Record (USER_DATA)

Response:

[

{

"id": "1125899906842624042",

"currency": "USDT",

"symbol": "BTC-220721-25000-C",

"exercisePrice": "25000.00000000",

"markPrice": "25000.00000000",

"quantity": "1.00000000",

"amount": "0.00000000",

"fee": "0.00000000",

"createDate": 1658361600000,

"priceScale": 2,

"quantityScale": 2,

"optionSide": "CALL",

"positionSide": "LONG",

"quoteAsset": "USDT"

}

]

GET /eapi/v1/exerciseRecord (HMAC SHA256)

Get account exercise records.

Weight:

5

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| symbol | STRING | NO | Option trading pair, e.g BTC-200730-9000-C |

| startTime | LONG | NO | startTime |

| endTime | LONG | NO | endTime |

| limit | INT | NO | default 1000, max 1000 |

| recvWindow | LONG | NO | |

| timestamp | LONG | YES |

Account Funding Flow (USER_DATA)

Response:

[

{

"id": 1125899906842624000,

"asset": "USDT", // Asset type

"amount": "-0.552", // Amount (positive numbers represent inflow, negative numbers represent outflow)

"type": "FEE", // type (fees)

"createDate": 1592449456000, // Time

},

{

"id": 1125899906842624000,

"asset": "USDT", // Asset type

"amount": "100", // Amount (positive numbers represent inflow, negative numbers represent outflow)

"type": "CONTRACT", // type (buy/sell contracts)

"createDate": 1592449456000, // Time

},

{

"id": 1125899906842624000,

"asset": "USDT", // Asset type

"amount": "10000", // Amount (positive numbers represent inflow, negative numbers represent outflow)

"type": "TRANSFER", // type(Funds transfer)

"createDate": 1592448410000, // Time

}

]

GET /eapi/v1/bill (HMAC SHA256)

Query account funding flows.

Weight:

1

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| currency | STRING | YES | Asset type, e.g USDT |

| recordId | LONG | NO | Return the recordId and subsequent data, the latest data is returned by default, e.g 100000 |

| startTime | LONG | NO | Start Time, e.g 1593511200000 |

| endTime | LONG | NO | End Time, e.g 1593512200000 |

| limit | INT | NO | Number of result sets returned Default:100 Max:1000 |

| recvWindow | LONG | NO | |

| timestamp | LONG | YES |

Websocket Market Streams

- The baseurl of the websocket interface is: *wss://nbstream.binance.com/eoptions/*

- Streams can be access either in a single raw stream or a combined stream

- Raw streams are accessed at /ws/<streamName>

- Combined streams are accessed at /stream?streams=<streamName1>/<streamName2>/<streamName3>

- Example:

wss://nbstream.binance.com/eoptions/ws/BTC-210630-9000-P@ticker-

wss://nbstream.binance.com/eoptions/stream?streams=BTC-210630-9000-P@trade/BTC-210630-9000-P@ticker -

A single connection is only valid for 24 hours; expect to be disconnected at the 24 hour mark

-

The websocket server will send a

ping frameevery 5 minutes. If the websocket server does not receive apong frameback from the connection within a 15 minute period, the connection will be disconnected. Unsolicitedpong framesare allowed. -

WebSocket connections have a limit of 10 incoming messages per second.

-

A connection that goes beyond the limit will be disconnected; IPs that are repeatedly disconnected may be banned.

-

A single connection can listen to a maximum of 200 streams.

-

Considering the possible data latency from RESTful endpoints during an extremely volatile market, it is highly recommended to get the order status, position, etc from the Websocket user data stream.

-

Combined stream events are wrapped as follows: {«stream»:»<streamName>»,»data»:<rawPayload>}

-

All symbols for streams are uppercase

-

A single connection is only valid for 24 hours; expect to be disconnected at the 24 hour mark

-

The websocket server will send a

ping frameevery 5 minutes. If the websocket server does not receive apong frameback from the connection within a 15 minute period, the connection will be disconnected. Unsolicitedpong framesare allowed. -

WebSocket connections have a limit of 10 incoming messages per second.

-

A connection that goes beyond the limit will be disconnected; IPs that are repeatedly disconnected may be banned.

-

A single connection can listen to a maximum of 200 streams.

-

Considering the possible data latency from RESTful endpoints during an extremely volatile market, it is highly recommended to get the order status, position, etc from the Websocket user data stream.

Live Subscribing/Unsubscribing to streams

- The following data can be sent through the websocket instance in order to subscribe/unsubscribe from streams. Examples can be seen below.

- The

idused in the JSON payloads is an unsigned INT used as an identifier to uniquely identify the messages going back and forth.

Subscribe to a stream

Response

{

"result": null,

"id": 1

}

- Request

{

«method»: «SUBSCRIBE»,

«params»:

[

«BTC-210630-9000-P@ticker»,

«BTC-210630-9000-P@depth»

],

«id»: 1

}

Unsubscribe to a stream

Response

{

"result": null,

"id": 312

}

- Request

{

«method»: «UNSUBSCRIBE»,

«params»:

[

«BTC-210630-9000-P@ticker»

],

«id»: 312

}

Listing Subscriptions

Response

{

"result": [

"BTC-210630-9000-P@ticker"

],

"id": 3

}

- Request

{

«method»: «LIST_SUBSCRIPTIONS»,

«id»: 3

}

Setting Properties

Currently, the only property can be set is to set whether combined stream payloads are enabled are not.

The combined property is set to false when connecting using /ws/ («raw streams») and true when connecting using /stream/.

Response

{

"result": null,

"id": 5

}

- Request

{

«method»: «SET_PROPERTY»,

«params»:

[

«combined»,

true

],

«id»: 5

}

Retrieving Properties

Response

javascript

{

"result": true, // Indicates that combined is set to true.

"id": 2

}

- Request

{

«method»: «GET_PROPERTY»,

«params»:

[

«combined»

],

«id»: 2

}

Error Messages

| Error Message | Description |

|---|---|

| {«code»: 0, «msg»: «Unknown property»} | Parameter used in the SET_PROPERTY or GET_PROPERTY was invalid |

| {«code»: 1, «msg»: «Invalid value type: expected Boolean»} | Value should only be true or false |

| {«code»: 2, «msg»: «Invalid request: property name must be a string»} | Property name provided was invalid |

| {«code»: 2, «msg»: «Invalid request: request ID must be an unsigned integer»} | Parameter id had to be provided or the value provided in the id parameter is an unsupported type |

{«code»: 2, «msg»: «Invalid request: unknown variant %s, expected one of SUBSCRIBE, UNSUBSCRIBE, LIST_SUBSCRIPTIONS, SET_PROPERTY, GET_PROPERTY at line 1 column 28″} |

Possible typo in the provided method or provided method was neither of the expected values |

| {«code»: 2, «msg»: «Invalid request: too many parameters»} | Unnecessary parameters provided in the data |

| {«code»: 2, «msg»: «Invalid request: property name must be a string»} | Property name was not provided |

{«code»: 2, «msg»: «Invalid request: missing field method at line 1 column 73″} |

method was not provided in the data |

| {«code»:3,»msg»:»Invalid JSON: expected value at line %s column %s»} | JSON data sent has incorrect syntax. ## Trade Streams |

Trade Streams

** Payload: **

{

"e":"trade", // event type

"E":1591677941092, // event time

"s":"BTC-200630-9000-P", // Option trading symbol

"t":1, // trade ID

"p":"1000", // price

"q":"-2", // quantity

"b":4611781675939004417, // buy order ID

"a":4611781675939004418, // sell order ID

"T":1591677567872, // trade completed time

"S":"-1" // direction

}

The Trade Streams push raw trade information for specific symbol or underlying asset. E.g.ETH@trade

Stream Name:

<symbol>@trade or <underlyingAsset>@trade

Update Speed: 50ms

Index Price Streams

** Payload: **

{

"e":"index", // event type

"E":1661415480351, // time

"s":"ETHUSDT", // underlying symbol

"p":"1707.89008607" // index price

}

Underlying(e.g ETHUSDT) index stream.

Stream Name:

<symbol>@index

Update Speed: 1000ms

Mark Price

** Payload: **

[

{

"e":"markPrice", // Event Type

"E":1663684594227, // Event time

"s":"ETH-220930-1500-C", // Symbol

"mp":"30.3" // Option mark price

},

{

"e":"markPrice",

"E":1663684594228,

"s":"ETH-220923-1000-C",

"mp":"341.5"

}

】

The mark price for all option symbols on specific underlying asset. E.g.ETH@markPrice

Stream Name:

<underlyingAsset>@markPrice

Update Speed: 1000ms

Kline/Candlestick Streams

** Payload: **

{

"e":"kline", // event type

"E":1638747660000, // event time

"s":"BTC-200630-9000-P", // Option trading symbol

"k":{

"t":1638747660000, // kline start time

"T":1638747719999, // kline end time

"s":"BTC-200630-9000-P", // Option trading symbol

"i":"1m", // candle period

"F":0, // first trade ID

"L":0, // last trade ID

"o":"1000", // open

"c":"1000", // close

"h":"1000", // high

"l":"1000", // low

"v":"0", // volume(in contracts)

"n":0, // number of trades

"x":false, // current candle has been completed Y/N

"q":"0", // completed trade amount (in quote asset)

"V":"0", // taker completed trade volume (in contracts)

"Q":"0" // taker trade amount(in quote asset)

}

}

The Kline/Candlestick Stream push updates to the current klines/candlestick every 1000 milliseconds (if existing).

Kline/Candlestick chart intervals:

m -> minutes; h -> hours; d -> days; w -> weeks; M -> months

«1m»,

«3m»,

«5m»,

«15m»

«30m»

«1h»,

«2h»,

«4h»,

«6h»,

«12h»,

«1d»,

«3d»,

«1w»,

Stream Name:

<symbol>@kline_<interval>

Update Speed: 1000ms

24-hour TICKER

** Payload: **

{

"e":"24hrTicker", // event type

"E":1657706425200, // event time

"s":"BTC-220930-18000-C", // Option symbol

"o":"2000", // 24-hour opening price

"h":"2020", // Highest price

"l":"2000", // Lowest price

"c":"2020", // latest price

"V":"1.42", // Trading volume(in contracts)

"A":"2841", // trade amount(in quote asset)

"P":"0.01", // price change percent

"p":"20", // price change

"Q":"0.01", // volume of last completed trade(in contracts)

"F":"27", // first trade ID

"L":"48", // last trade ID

"n":22, // number of trades

"bo":"2012", // The best buy price

"ao":"2020", // The best sell price

"bq":"4.9", // The best buy quantity

"aq":"0.03", // The best sell quantity

"b":"0.1202", // BuyImplied volatility

"a":"0.1318", // SellImplied volatility

"d":"0.98911", // delta

"t":"-0.16961", // theta

"g":"0.00004", // gamma

"v":"2.66584", // vega

"vo":"0.10001", // Implied volatility

"mp":"2003.5102", // Mark price

"hl":"2023.511", // Buy Maximum price

"ll":"1983.511", // Sell Minimum price

"eep":"0" // Estimated strike price (return estimated strike price half hour before exercise)

}

24hr ticker info for all symbols. Only symbols whose ticker info changed will be sent.

Stream Name:

<symbol>@ticker

Update Speed: 1000ms

24-hour TICKER by underlying asset and expiration data

** Payload: **

[

{

"e":"24hrTicker", // event type

"E":1657706425200, // event time

"s":"ETH-220930-1600-C", // Option symbol

"o":"2000", // 24-hour opening price

"h":"2020", // Highest price

"l":"2000", // Lowest price

"c":"2020", // latest price

"V":"1.42", // Trading volume(in contracts)

"A":"2841", // trade amount(in quote asset)

"P":"0.01", // price change percent

"p":"20", // price change

"Q":"0.01", // volume of last completed trade(in contracts)

"F":"27", // first trade ID

"L":"48", // last trade ID

"n":22, // number of trades

"bo":"2012", // The best buy price

"ao":"2020", // The best sell price

"bq":"4.9", // The best buy quantity

"aq":"0.03", // The best sell quantity

"b":"0.1202", // BuyImplied volatility

"a":"0.1318", // SellImplied volatility

"d":"0.98911", // delta

"t":"-0.16961", // theta

"g":"0.00004", // gamma

"v":"2.66584", // vega

"vo":"0.10001", // Implied volatility

"mp":"2003.5102", // Mark price

"hl":"2023.511", // Buy Maximum price

"ll":"1983.511", // Sell Minimum price

"eep":"0" // Estimated strike price (return estimated strike price half hour before exercise)

},

{

"e":"24hrTicker",

"E":1663685112123,

"s":"ETH-220930-1500-C",

"o":"34.9",

"h":"44.6",

"l":"26.8",

"c":"26.8",

"V":"11.84",

"A":"444.37",

"P":"-0.232",

"p":"-8.1",

"Q":"0",

"F":"91",

"L":"129",

"n":39,

"bo":"26.8",

"ao":"33.9",

"bq":"0.65",

"aq":"0.01",

"b":"0.88790536",

"a":"0.98729014",

"d":"0.2621153",

"t":"-3.44806807",

"g":"0.00158298",

"v":"0.7148147",

"vo":"0.93759775",

"mp":"30.3",

"hl":"228.7",

"ll":"0.1",

"eep":"0"

}

]

24hr ticker info by underlying asset and expiration date. E.g.ETH@ticker@220930

Stream Name:

<underlyingAsset>@ticker@<expirationDate>

Update Speed: 1000ms

Open Interest

[

{

"e":"openInterest", // Event type

"E":1668759300045, // Event time

"s":"ETH-221125-2700-C", // option symbol

"o":"1580.87", // Open interest in contracts

"h":"1912992.178168204" // Open interest in USDT

}

]

Option open interest for specific underlying asset on specific expiration date. E.g.ETH@openInterest@221125

Stream Name:

<underlyingAsset>@openInterest@<expirationDate>

Update Speed: 60s

New Symbol Info

{

"e":"OPTION_PAIR", //eventType

"E":1668573571842, //eventTime

"id":652, //option id

"cid":2, //underlying asset id

"u":"BTCUSDT", //Underlying index of the contract

"qa":"USDT", //Quotation asset

"s":"BTC-221116-21000-C", //Trading pair name

"unit":1, //Conversion ratio, the quantity of the underlying asset represented by a single contract.

"mq":"0.01", //Minimum trade volume of the underlying asset

"d":"CALL", //Option type

"sp":"21000", //Strike price

"ed":1668585600000 //expiration time

}

New symbol listing stream.

Stream Name:

option_pair

Update Speed: 50ms

Partial Book Depth Streams

** Payload: **

{

"e":"depth", // event type

"T":1591695934010, // transaction time

"s":"BTC-200630-9000-P", // Option symbol

"u":162, // update id in event

"pu":162, // same as update id in event

"b":[ // Buy order

[

"200", // Price

"3", // quantity

],

[

"101",

"1"

],

[

"100",

"2"

]

],

"a":[ // Sell order

[

"1000",

"89"

]

]

}

Top bids and asks, Valid levels are are 10, 20, 50, 100.

Stream Names: <symbol>@depth<levels> OR <symbol>@depth<levels>@100ms OR <symbol>@depth<levels>@1000ms.

Update Speed: 100ms or 1000ms, 500ms(default when update speed isn’t used)

Diff. Book Depth Streams

** Payload: **

{

"e":"depth", // event type

"T":1591695934010, // transaction time

"s":"BTC-200630-9000-P", // option symbol

"u":62610, // final update id in event

"pu":62609, // final update id in last stream (ie. `u` in last stream event)

"b":[ // buy order

[

"200", // price

"3", // quantity

],

[

"101",

"1"

],

[

"100",

"2"

]

],

"a":[ // sell order

[

"1000",

"89"

]

]

}

When depth level is set to 1000, stream returns diff book depth pushed every 50ms. Please follow the subsequent instructions on how to manage a local order book correctly.

Stream Names: <symbol>@depth1000

Update Speed: 50ms

How to manage a local order book correctly

- Open a diff. Book depth stream to wss://nbstream.binance.com/eoptions/stream?streams=ETH-221230-1200-P@depth1000.

- Buffer the events you receive from the stream. For same price, latest received update covers the previous one.

- Get a depth snapshot from https://eapi.binance.com/eapi/v1/depth?symbol=ETH-221230-1200-P&limit=1000 .

- Drop any event from the websocket stream where

uis <= theufrom the step 3 - The first processed event should have

u>ufrom step 3 ANDpu=ufrom step 3 - While listening to the stream, each new event’s

pushould be equal to the previous event’su, otherwise initialize the process from step 3. - The data in each event is the absolute quantity for a price level.

- If the quantity is 0, remove the price level.

- Receiving an event that removes a price level that is not in your local order book can happen and is normal.

User Data Streams

- The base API endpoint is: https://eapi.binance.com

- A User Data Stream

listenKeyis valid for 60 minutes after creation. - Doing a

PUTon alistenKeywill extend its validity for 60 minutes. - Doing a

DELETEon alistenKeywill close the stream and invalidate thelistenKey. - Doing a

POSTon an account with an activelistenKeywill return the currently activelistenKeyand extend its validity for 60 minutes. - Connection method for Websocket:

- Base Url: wss://nbstream.binance.com/eoptions/

- User Data Streams are accessed at /ws/<listenKey>

- Example:

wss://nbstream.binance.com/eoptions/ws/XaEAKTsQSRLZAGH9tuIu37plSRsdjmlAVBoNYPUITlTAko1WI22PgmBMpI1rS8Yh

- A single connection is only valid for 24 hours; expect to be disconnected at the 24 hour mark

Start User Data Stream (USER_STREAM)

Response:

{

"listenKey": "pqia91ma19a5s61cv6a81va65sdf19v8a65a1a5s61cv6a81va65sdf19v8a65a1"

}

POST /eapi/v1/listenKey

Start a new user data stream. The stream will close after 60 minutes unless a keepalive is sent. If the account has an active listenKey, that listenKey will be returned and its validity will be extended for 60 minutes.

Weight:

1

Parameters:

None

Keepalive User Data Stream (USER_STREAM)

Response:

{}

PUT /eapi/v1/listenKey

Keepalive a user data stream to prevent a time out. User data streams will close after 60 minutes. It’s recommended to send a ping about every 60 minutes.

Weight:

1

Parameters:

None

Close User Data Stream (USER_STREAM)

Response:

{}

DELETE /eapi/v1/listenKey

Close out a user data stream.

Weight:

1

Parameters:

None

Event: Account data

Payload:

{

"e":"ACCOUNT_UPDATE", // Event type

"E":1591696384141, // Event time

"B":[

{

"b":"100007992.26053177", // Account balance

"m":"0", // Position value

"u":"458.782655111111", // Unrealized profit/loss

"U":200, // Positive unrealized profit for long position

"M":"-15452.328456", // Maintenance margin

"i":"-18852.328456", // Initial margin

"a":"USDT", // Margin asset

}

],

"G":[

{

"ui":"SOLUSDT", // Underlying

"d":-33.2933905, // Delta

"t":35.5926375, // Theta

"g":-14.3023855, // Gamma

"v":-0.1929375 // Vega

}

],

"P":[

{

"s":"SOL-220912-35-C", // Contract symbol

"c":"-50", // Number of current positions

"r":"-50", // Number of positions that can be reduced

"p":"-100", // Position value

"a":"2.2", // Average entry price

}

],

"uid":1000006559949

}

- Update Speed: 50ms

- Update under the following conditions:

- Account deposit or withdrawal

- Position info change. Includes a P attribute if there are changes, otherwise does not include a P attribute.

- Greek update

Event: Order update

Payload:

{

"e":"ORDER_TRADE_UPDATE", //Event Type

"E":1657613775883, //Event Time

"o":[

{

"T":1657613342918, //Order Create Time

"t":1657613342918, //Order Update Time

"s":"BTC-220930-18000-C", //Symbol

"c":"", //clientOrderId

"oid":"4611869636869226548", //order id

"p":"1993", //order price

"q":"1", //order quantity

"stp":0, //not used for now

"r":false, //reduce only

"po":true, //post only

"S":"PARTIALLY_FILLED", //status

"e":"0.1", //completed trade volume(in contracts)

"ec":"199.3", //completed trade amount(in quote asset)

"f":"2", //fee

"tif": "GTC", //time in force

"oty":"LIMIT", //order type

"fi":[

{

"t":"20", //tradeId

"p":"1993", //trade price

"q":"0.1", //trade quantity

"T":1657613774336, //trade time

"m":"TAKER" //taker or maker

"f":"0.0002" //commission(>0) or rebate(<0)

}

]

}

]

}

- Update Speed: 50ms

- Update under the following conditions:

- Order fills

- Order placed

- Order cancelled

Market Maker Endpoints

Market maker endpoints only work for option market makers, api users will get error when send requests to these endpoints.

Option Margin Account Information (USER_DATA)

Response:

{

"asset": [

{

"asset": "USDT", // Asset type

"marginBalance": "10099.448" // Account balance

"equity": "10094.44662", // Account equity

"available": "8725.92524", // Available funds

"initialMargin": "1084.52138", // Initial margin

"maintMargin": "151.00138", // Maintenance margin

"unrealizedPNL": "-5.00138", // Unrealized profit/loss

"lpProfit": "-5.00138", // Unrealized profit for long position

}

],

"greek": [

{

"underlying":"BTCUSDT" // Option Underlying

"delta": "-0.05" // Account delta

"gamma": "-0.002" // Account gamma

"theta": "-0.05" // Account theta

"vega": "-0.002" // Account vega

}

],

"time": 1592449455993 // Time

}

GET /eapi/v1/marginAccount (HMAC SHA256)

Get current account information.

Weight:

3

Parameters:

| Name | Type | Mandatory | Description |

|---|---|---|---|

| recvWindow | LONG | NO | |

| timestamp | LONG | YES |

Set Market Maker Protection Config (TRADE)

{

"underlyingId": 2,

"underlying": "BTCUSDT",

"windowTimeInMilliseconds": 3000,